The Simple Answer? Yes, but why? An umbrella policy provides a cost effective way to provide higher limits to protect the community for unforeseen liability losses. When an accident happens, this policy can provide peace of mind and help avoid the need for a special assessment.

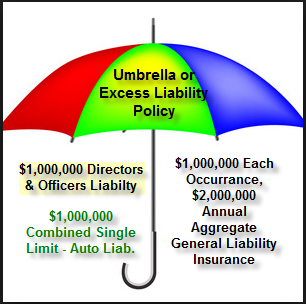

An umbrella or excess liability policy provides additional limits to supplement your primary liability policies. An umbrella policy covers a much higher limit. The main purpose of an umbrella policy is to protect your community’s assets from an unforeseen event, such as a tragic accident in which you are held responsible for damages or bodily injuries. Coverage extends excess of the general liability and auto liability. Most insurance companies will also add excess Directors & Officers (D&O) Liability – but you may need to request it.

Below is a graphic of how coverage will work in the event of a catastrophic event. The claim would be reported to one or more of the primary policies – general liability, D&O or Auto Liability – who would be the first to respond. The umbrella insurance company would also be notified of the loss. If the full limits of the primary policy are paid, the umbrella should then come into play.

Unfortunately, despite everyone’s best efforts, losses do happen. Here are some actual claims that ended up involving both the primary and excess liability policies.

Not too long ago, some trees and shrubs at a community entryway became overgrown to the point that they covered up a stop sign. Two vehicles collided in the intersection and passengers in both cars were badly hurt. The community was held responsible for the accident and was liable for the significant medical bills.

Can you imagine not having an umbrella policy and receiving a judgment against your community for $30.7 million? That happened to an Indiana homeowners association in March, 2011. Ten years earlier, some children were playing on the edge of the community’s lake when the ice gave way. One child drowned, another child received traumatic brain injury, and the third child witnessed the drowning and injury of his two brothers. Typically, this type of accident is considered an act of God and a plaintiff cannot recover damages for the injuries. However, in this case, the jury found the Community 100% liable for the damages for two reasons. First, the ice was thin due to incorrect management of water-flow. Second, there were no warning signs or barriers near the water.

Even Directors & Officers claims can exceed that policy’s limits. A couple in Hawaii sued claiming they were targets of threats, harassment and intimidation by an unlicensed contractor and the resident manager. According to the lawsuit, the community’s board of directors either directed or condoned the campaign of abuse. The jury found the condominium association’s board of directors, its employees and agents violated state condominium laws and awarded the couple $3.87 million in general and punitive damages.

An umbrella policy provides a cost effective way to provide higher limits to protect the community for unforeseen liability losses. When an accident happens, this policy can provide peace of mind and help avoid the need for a special assessment.

If you do not already have this important coverage, the team at CiraConnect Insurance Services will be happy to provide a quote for you. What limit would you like? Options from $1,000,000 to $25,000,000 are generally available. You might be surprised how affordable excess liability coverage is.

Contact CiraConnect Insurance Services today for your free quote!