Part 1 : Introduction to The Budget

Part 1 | Part 2 | Part 3 | Part 4

What is a Budget? A budget is an annual financial plan for an organization - in this case, a community association. A budget provides an estimate of a community’s revenue and expenses for a specified period of time. It is the first step in managing your community’s financial operations.

What is the purpose of a budget in Community Management? A budget establishes what services the community will provide, when they will be done, and how they will be done. In other words, a budget reflects the board’s policy decisions about what will be accomplished and what will not be accomplished during the budget period.

How is a Budget Used? Utilizing the budget as a management tool, it has many uses:

- It is a way for the community to plan activities, not to predict

- It is the basis for determining owner assessments

- Together with financial reports, it is a means of controlling the community’s financial operations

- It provides for continuity of community services

- It helps the community maintain its desired quality of life

- It helps to limit surprises and minimize the unexpected

- It provides an opportunity for a community to balance its needs and desires (mandatory and discretionary items)

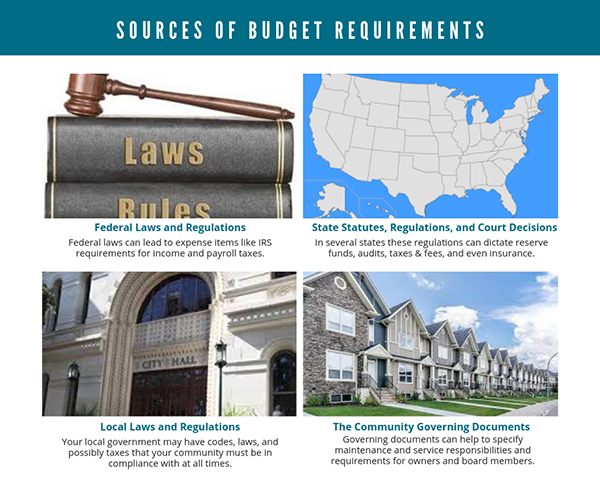

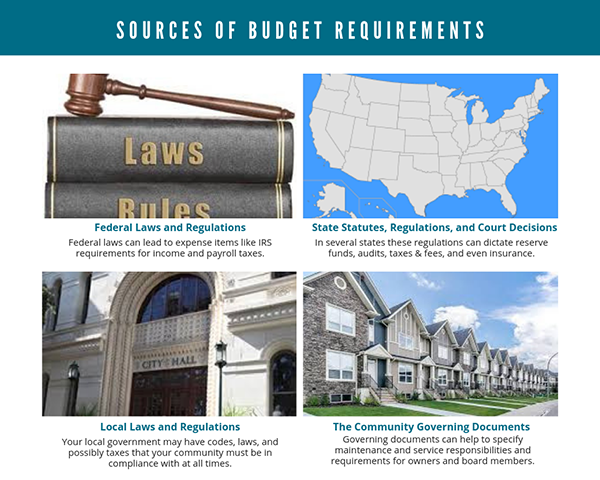

Sources of Budget Requirements: Budget items will vary from one community association to another. They also will vary from year to year for the same association. Many budget items develop in the normal course of doing business. However, a number of budget items appear because they are required by:

- Federal laws and regulations: Federal laws and regulations can lead to community expense items. For example, all community associations must conform to IRS requirements regarding income and payroll taxes. Federal agencies may also establish expense requirements that your community will have to meet. For example, in the environmental area, you may have to budget for hazardous waste disposal. Federally established secondary mortgage institutions such as Fannie Mae, Freddie Mac, FHA or VA may also set requirements that your community association will have to meet if owners are to participate in their financing or repurchase programs.

- State statutes, regulations and court decisions: All states have statutes that enable the establishment of condominiums, corporations, and/or planned communities. In several states, these statutes require or regulate such community association budget items as replacement reserves, audits, stage taxes and fees, insurance, and the conduct of financial operations. What a specific state statute says very often will override what your community’s governing documents say. Check the state statute’s wording carefully to determine its applicability to your association.

- Local laws and regulations: Your local government may have codes, laws, and possibly taxes with which your community association must comply. Any requirements in these areas will result in expense items for your community’s budget. For example, your local fire code may require such items as sprinkler systems, exit signs, fire extinguishers, or elevator inspections. Your local health and safety codes may require pool inspections, water quality tests, or mandatory procedures for sewage disposal or recycling. Property taxes may or may not be levied on land commonly owned by the community association, depending on your state or local jurisdiction.

- The community’s governing documents: The governing documents of your community define the property to be maintained by the association, and specifies maintenance and service responsibilities and requirements. These maintenance and service items will appear in the “expenses” section of your community’s budget.

Budget Components: The two main components of a community budget are revenue and expenses. The typical sources of revenue for a community association include:

▪ Revenue consists of the collective items or amounts of income which, in the case of a community association, are appropriated for common expenses. The typical sources of revenue for a community association include:

- Owner assessments: An assessment is the owner’s financial obligation to the community association during a given period of time -- usually one year. It covers the owner’s share of the common expense. An annual assessment may be paid on a monthly, quarterly, or annual basis, or however the governing documents dictate. Most of a community’s revenue will come from owner assessments. Occasionally, special assessments may be levied. A special assessment is a one-time assessment often voted on by the owners to cover a major expense that was not included in the annual budget or replacement reserve.

- Interest: A typical source of revenue for communities is interest of dividends earned on their cash savings and investments.

- Other Revenue: Other sources of revenue include late payment fees, fines, user fees (i.e. parking space rentals, move-in/move-out fees, etc.), clubhouse rental fees, collection or insurance claims, legal settlements, or easements.

▪ Expenses consist of the cost of goods and services used to operate and maintain the association’s common elements. Typically there are three types of expenses for community associations:

- Operating Expenses: Operating expenses occur on a regular basis for the normal and usual services and repairs for the association. For example:

- Swimming pool management

- Professional and administrative services (management, legal, financial, insurance)

- Utilities (electric, gas, water, oil)

- Contract services (lawn maintenance, elevator, trash removal, janitorial services, painting)

- Repairs (plumbing, electrical, doors and locks)

- Personnel costs (compensation and benefits for community employees)

- Educational costs for employees, board members and volunteers (memberships, courses and publications from Community Associations Institute)

- Major Improvement Expenses: Major improvement expenses consist of items that are not necessarily required, but are added to improve the quality of life for the residents, appearance of the property -- or to enhance the value of the community association as reflected in the resale value of units. A major improvement expense this year becomes a reserve items in the following and future years. Maintenance, repair or replacement. They increase the life, usefulness or value of a property. They are called major improvements because they last more than one year and involve a large amount of funding. For example, the addition of a new tennis court, more picnic/park areas, additional lighting, etc. .

- Reserve Account: The establishment of a reserve account is a community association expense that requires detailed explanation.

Future Articles will include more in depth looks at how to prepare the budget, budgetary roles and responsibilities, and reserve funding and allocation.